Writing Off Motor Vehicle Expenses as a Canadian Massage Therapist

The Day I Learned to Respect the Humble Logbook

I opened the door to my friend’s car and got in. Before we even backed out of the driveway, she popped open her glove box and pulled out a small notebook.

She looked a bit flustered and frantic. We were already running late, but she refused to start the car until she’d updated her travel log. She carefully wrote down the date, the time, the odometer reading, and the address of where she was. Then she added a short note explaining the purpose of her trip.

The level of detail was unbelievable. I had never seen anything like it before—nor have I since.

As a nerdy accountant who cares deeply about CRA compliance, I was impressed. The best part? This friend wasn’t running a business! She simply liked having a record of where she’d been and what she’d done. For her, it functioned like a journal.

For RMTs who are using their personal vehicles to earn business income, that same kind of recordkeeping isn’t just impressive—it’s essential.

If you use your car for your massage therapy business, here’s what you need to know about writing off your motor vehicle expenses.

1. You Can Deduct the Business-Related Use of Your Personal Vehicle

If you’re a registered massage therapist in Canada and you use your personal vehicle for business purposes—such as driving to clients’ homes, purchasing supplies, or attending continuing education courses—you may be able to deduct a portion of your vehicle expenses.

The key word here is portion. You can only write off the part of your vehicle use that directly relates to earning business income. And to figure out what that percentage is, you’ll need one very important tool: a vehicle logbook.

2. The CRA Vehicle Logbook: Your Best Friend (and the CRA’s)

A vehicle logbook tracks all your business-related driving throughout the year. It’s how you calculate the percentage of your total driving that was for business purposes.

Here’s what you need to do:

Record your odometer reading on January 1.

Walk out to your car, check the odometer, and write it down.Record each business trip you make.

For every trip related to your RMT practice, note the date, destination, purpose, and number of kilometers driven.Record your odometer reading again on December 31.

This gives you the total kilometers driven during the year.

Once you have those numbers, you can calculate your business-use percentage. For example:

Total kilometers driven: 20,000

Business kilometers (from your logbook): 2,000

Business-use percentage: 10%

That means 10% of your vehicle’s expenses can be deducted as a business expense.

3. How to Calculate Your Deduction

Let’s walk through an example.

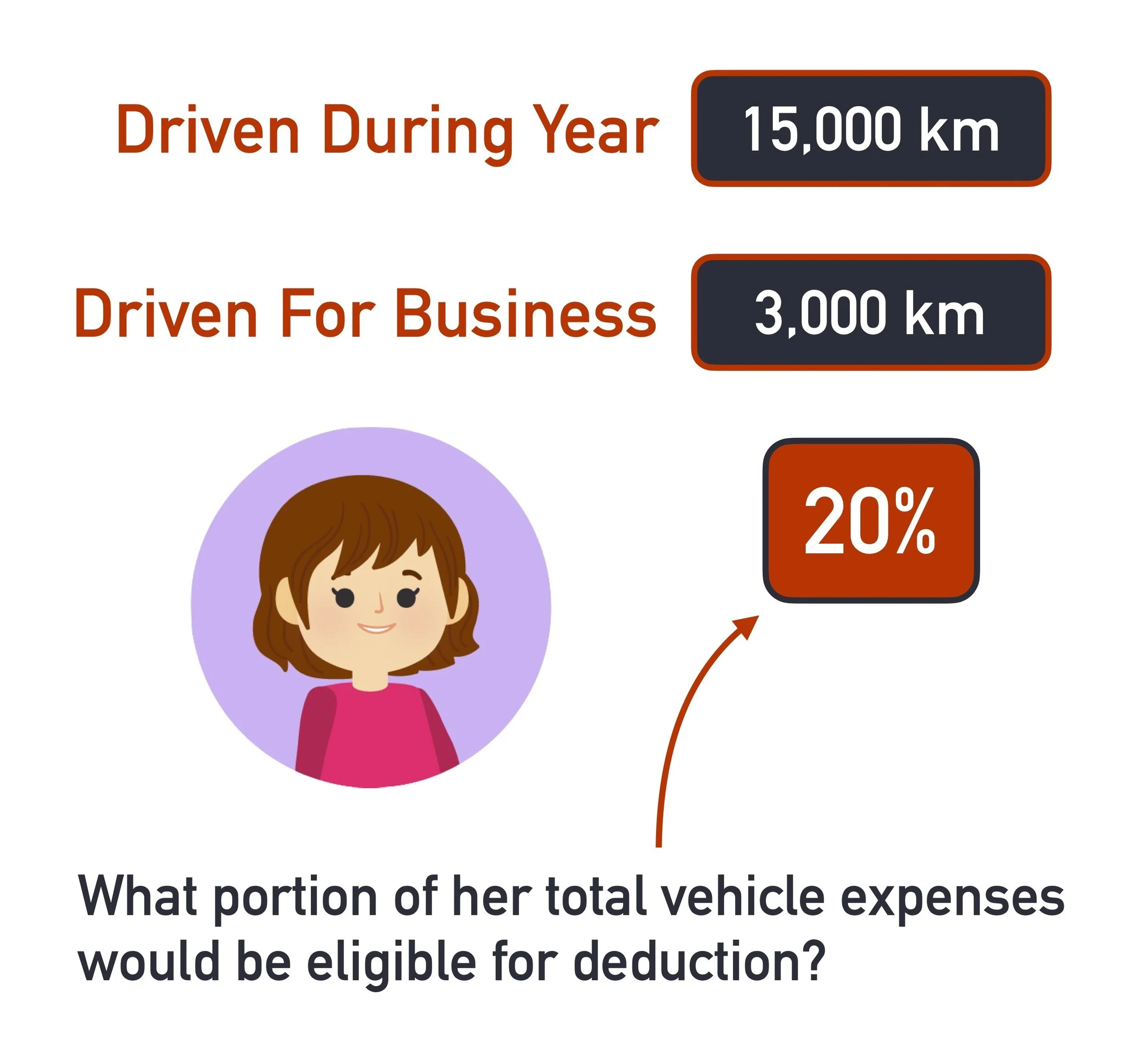

Suppose an RMT runs a mobile massage therapy business and drives 15,000 km during the year. Her logbook shows that 3,000 km were for business purposes—that’s 20% business use.

Now let’s say her annual vehicle expenses were:

Fuel $2,000

Insurance $1,800

Interest $400

License & Registration $100

Maintenance & Repairs $500

Total $4,800

Since 20% of her driving was for business, she can deduct 20% of these expenses: $4,800 × 20% = $960.

If she also had any business-only vehicle expenses (like parking for client appointments or additional business insurance), she can deduct those in full.

In this example, that might include:

$50 in business parking

$300 in supplemental business insurance

Adding those brings her total eligible deduction to $1,310.

4. Can You Use the CRA’s Per-Kilometer Rates?

You may have heard of another way to calculate vehicle expenses using the CRA’s per-kilometer vehicle allowance rates. Here’s how it works: instead of tracking your actual vehicle expenses, you multiply your business kilometers by the CRA’s per-kilometer rate for that year.

Sounds easier, right? Unfortunately, not everyone can use this method.

If you’re a sole proprietor:

You cannot use the per-kilometer method. You must track your expenses and deduct the portion that relates to business use, as shown in the example above.If you’re incorporated:

You can use the per-kilometer method. In this case, the corporation pays you a reasonable vehicle allowance based on CRA’s prescribed rates.

Unfortunately, some online resources have published conflicting or incomplete information, which has caused confusion for many RMTs.

5. Keep Your Records Straight

To keep the CRA happy, you’ll need two main things:

Your vehicle logbook

→ CRA: Motor Vehicle RecordsReceipts for all your vehicle expenses (fuel, maintenance, insurance, etc.)

And if you own your vehicle, you may also claim Capital Cost Allowance (CCA) to account for depreciation. This is a complicated subject that I’m not going to cover in detail in this article, but here is a link from the CRA explaining what CCA is. → CRA: Capital Cost Allowance Classes

6. When It’s Worth It and When It’s Not

If you operate a mobile massage therapy practice, tracking your vehicle expenses is almost always worth it. Your business mileage will add up quickly, and so will your deductions.

But if you work exclusively at a clinic and only use your vehicle occasionally for things like courses or picking up supplies, it may not be worth the time it takes to maintain the records. In that case, your deduction might be too small to justify the effort.

Final Thoughts

Keeping a detailed logbook might not be the most exciting part of being an RMT, but it’s one of the smartest ways to protect yourself and maximize your deductions.

When it comes to CRA compliance, good records are your best defense and your best opportunity to keep more of what you earn.

If you’re interested in learning more, please check out my course Business & Income Tax Essentials for RMTs.

Disclaimer

The information provided in this article is for general educational purposes only and does not constitute professional accounting, tax, or legal advice. While every effort has been made to ensure accuracy as of the date of publication, tax laws and CRA policies are subject to change. Readers should consult a qualified accountant or tax professional regarding their specific circumstances before acting on any information contained herein.